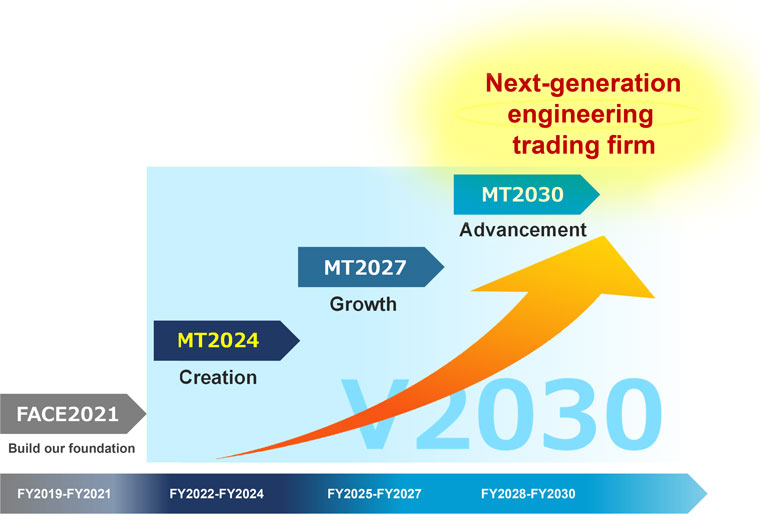

The social and business environment have been undergoing a significant transformation. This made us realize more than ever, in looking back on the previous medium-term business plan, the necessity of fundamental review of how we operate our business and strategy development from a longer-term perspective. We therefore decided to review our mission, as well as the reason of our existence, and have formulated a new philosophy and V2030, a growth strategy with an eye on how we should be as a company in 2030. They include how we answer to what is expected from society.

V2030 Growth Strategy (Vision2030)

V2030 Basic Strategies

| 1. Aggressive investments | ■ Investments towards business expansion, strengthening, and creation, as well as solutions to social issues. |

|---|---|

| 2. Management focus on long-term value, in addition to short-term profit | ■ Build management base, for medium- to long-term profitability by improving capital efficiency. |

| 3. Contributing to various stakeholders: Customers, employees, suppliers, communities, and shareholders | ■ Achieve a sustainable society by addressing our materialities. |

| 4. Shift from product-only sales to products and integrated solutions business model | ■ Proposals for embedded-services business, and subscriptions models, etc. |

| 5. Capturing global growth | ■ Make more business dealings with foreign companies. |

| 6. Promotion of digital transformation | ■ Significantly improve productivity, and creation of innovative business models. |

V2030 Quantitative Targets (Consolidated)

| Net sales | Operating income | ROE |

|---|---|---|

| ¥300.0 billion | ¥12.5 billion | 10% |

Medium-term Business Plan MT2024

Qualitative Targets

1. Business strategies for growth

| ① Strengthening engineering capabilities | ■ Strengthen our one-of-a-kind engineering capabilities, to strive to be the next-generation engineering trading firm. |

|---|---|

| ② Strategic business investment | ■ Create economic values through our business, as well as make strategic investments for further growth. |

| ③ Expansion of business with global companies | ■ Develop more business dealings with foreign companies, through increased overseas staff and improved infrastructure, to capture global economic growth. ー Primary fields and global regions |

| ④ Progressing digital transformation | ■ Workload efficiency and improved productivity, leveraging digital technologies. ■ Existing business expansion through big data and Create new businesses by proactively utilizing IoT & AI. ■ Secure competent human resources for digital transformations, and improve employees’ IT literacy. |

2. Strengthening management base

| ① Deepening corporate governance | ■ Establish highly transparent corporate governance, along with addressing corporate governance code. |

|---|---|

| ② Strengthening risk management | ■ Strengthen management framework for handing all sorts of business risks, to sustainably enhance a group-wide corporate value. |

| ③ Strengthening financial strategies | ■ Implement reformation of our earning model by growth investments and improve capital efficiency, keeping a stable financial base. |

| ④ Strengthening human resources strategies | ■ Aggressive investments in HR. ■ Straighten training systems for all group companies’ employees. ■ Train, recruit, and post HR, which is directed to a highly professional and diverse organization. |

| ⑤ Promotion of sustainability management | ■ Sustainable creation social and economic values, based upon management philosophy, and basic sustainability. |

Quantitative Targets(Consolidated)

Yen in millions| FY2021 Results |

FY2022 Targets |

FY2023 Targets |

FY2024 Targets |

|

|---|---|---|---|---|

| Orders Received | 154,702 | 170,000 | 180,000 | 200,000 |

| Net Sales | 148,075 | 140,000 | 170,000 | 185,000 |

| Operating Income | 6,866 | 5,500 | 7,000 | 8,500 |

| Ordinary Income | 7,792 | 5,800 | 7,200 | 8,700 |

| Profit attributable to owners of parent | 5,363 | 3,900 | 4,800 | 5,800 |

| ROE | 9.6% | 10% | ||

Dividend Policy (Consolidated)

We position profit distribution to shareholders as a management policy. Comprehensively taking into consideration future business development, including investments for growth to achieve V2030; constant and stable dividend payout; and other factors, we will pay out appropriate levels of dividends in accordance with our business performance. As a standard guide, the dividend payout ratio will be 30% of profit attributable to owners of parent.

By steadily implementing the plan, we strive to be a trading firm focused on one-of-a-kind engineering that leads the next generation.