Corporate Governance

Basic Corporate Governance Policy

From the perspective of reinforcing our corporate capabilities to survive global competition, we place high priority on promoting accurate and speedy business decision-making, while at the same time, enhancing our management oversight function to ensure the transparency of our business.

Overview of the Company’s Corporate Governance

Board of Directors

The Board of Directors comprises nine directors (including three outside directors).The board determines basic business policies and other important matters through vigorous exchanges of opinions while also fulfilling its function as an oversight body for business execution.

Moreover, in an effort to further enhance its corporate value, the Company has adopted the executive officer system to conduct flexible and efficient business operations by reinforcing the business decision making and supervising functions, as well as separating the business execution function. The Company dispatches certain executive officers to be in charge of its consolidated subsidiaries in Japan and overseas and to manage their business execution.

Audit & Supervisory Board

The Company uses an Audit & Supervisory Board system comprised of three Audit & Supervisory Board Members, two of whom are outside Audit & Supervisory Board Members. In addition to attending every Board of Directors meeting, the Full-time Audit & Supervisory Board Members attend other important internal meetings to monitor the business execution performance of directors from an objective perspective. Audit & Supervisory Board Members work to ensure the effective implementation of the audit by receiving reports on and explanations of the audit plan and results from independent auditor; exchanging opinions on the areas to be covered by the audit, the audit methods, and the audit results; sharing information; and taking other measures.

Independent Auditor and the Internal Audit System

The Company has concluded an auditing agreement with the certified public accounting firm Deloitte Touche Tohmatsu LLC to act as its independent auditor. In addition to providing accounting auditing services in a fair and unbiased manner, the auditing firm provides advice on accounting matters as appropriate.

As for the internal audit system of which the central organ is the Internal Audit Division, the job execution of employees is checked and assessed as to whether it is in accordance with laws and regulations and the Articles of Incorporation, as well as with the basic internal control policy and the code of conduct.

Transition to Stronger Corporate Governance

At DJK, we are working to strengthen corporate governance by ensuring the diversity of the Board of Directors while also making the Board progressively more effective through measures such as effectiveness evaluation and the establishment of the Governance Committee.

Reason for Appointment of Outside Officers

Skill Matrix of Directors

Governance Committee

The Governance Committee was established on October 1, 2020, and has been operated as a voluntary advisory body to the Board of Directors to deliberate on matters related to the nomi-nation and remuneration of top management (directors with representative authority) and directors, as well as other governance matters, and to report and make proposals to the Board of Directors, with the aim of enhancing corporate value by utilizing the knowledge and advice of outside directors, ensuring transparency and fairness, and strengthening governance. The composition and activities of the committee are outlined below.

Evaluating the Effectiveness of the Board of Directors

With regard to the effectiveness of the Board of Directors, the Board confirmed that efforts were being made to improve issues identified in the previous fiscal year’s effectiveness evaluation and the effectiveness of its response during the current fiscal year. The evaluation method and results for the fiscal year ended March 31, 2024 and the policy for initiatives for the fiscal year ending March 31, 2025 based on the issues identified in the Board of Directors’ effectiveness evaluation results for the fiscal year ended March 31, 2023 are as follows.

<Evaluation method>

December 2023: A questionnaire survey was conducted among all Directors and Audit & Supervisory Board members at the Board of Directors’ meeting (named responses)

February 2024: The Board of Directors conducted an analysis and evaluation of the responses to the survey, and discussed future initiatives

Officers’ Remuneration

Policy on Determining the Amount or Calculation Method for the Amount of Remuneration for Officers

The Company has established a policy regarding the determination of the amount or calculation method for the amount of remuneration for officers, which encourages medium- to long-term growth of business performance and corporate value. The remuneration system is commensurate with the duties of each officer.

The Governance Committee, upon consultation from the Board of Directors, deliberates and advises the Board on remuneration for individual directors other than outside directors. The Board of Directors deliberates on the advice from the Governance Committee and determines the amounts of remuneration.

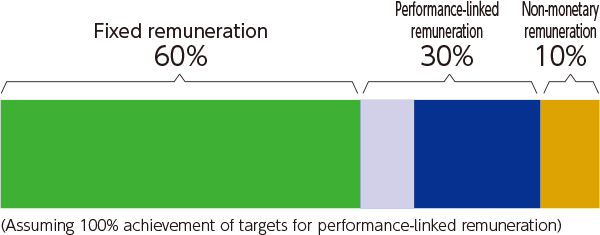

Remuneration for the Company’s officers is composed of fixed remuneration, performance-linked remuneration, non-monetary remuneration, etc. The relative proportions of each form of remuneration for executive directors and the amounts of remuneration are determined by the Board of Directors based on comparison and verification with the composition of remuneration at other companies of a similar scale in the same industry and the remuneration paid previously, as well as consultation and advice from the Governance Committee, from the perspective of ensuring objectivity and appropriateness. Remuneration for Audit & Supervisory Board members and outside directors, in light of the independence of their positions, consists of fixed remuneration only. Decisions on the amounts of remuneration are made within the extent of the total amounts passed in resolutions of the General Meeting of Shareholders.

Overview of the Remuneration System for Directors (Excluding Outside Directors)

DJK aims to further strengthen corporate governance under our medium-term business plan MT2024, launched in FY2022. As part of this plan, we have reviewed our remuneration system for officers as shown under “outline of each remuneration” in order to further enhance corporate value over the medium to long term.

Based on the resolution adopted by the Ordinary General Meeting of Shareholders held on June 23, 2022, the Company has decided to change the amount of remuneration, etc. for directors from a monthly amount to a yearly amount, and within the amount of such remuneration, directors other than outside directors will be paid a bonus in the form of performance-linked remuneration in addition to fixed remuneration, determined comprehensively taking into account trends in the level of remuneration and the number of directors, as well as future prospects, so as not to exceed ¥450 million per year.

Outline of Each Remuneration

Fixed remuneration

A monthly fixed amount of remuneration commensurate with the clarified roles and responsibilities of each position is paid in cash.

Performance-linked remuneration

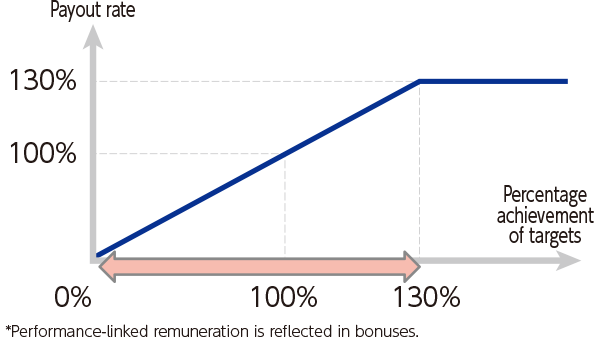

There are two kinds of bonuses to be paid: bonus linked to the Company’s business results indicators (hereinafter, “bonus A”) and bonus linked to indicators, etc. contributing to the achievement of the medium-term business plan (hereinafter, “bonus B”). Bonus A is paid in cash based on the degree of achievement of the consolidated performance targets, and bonus B is paid in cash according to the degree of achievement of the indicators, etc. contributing to the achievement of the medium-term business plan. The amounts vary within the range of 0% to 130% of the base amount.

Method for calculating performance-linked remuneration (Bonus A)

Performance indicators for performance-linked remuneration (Bonus A) are consolidated operating income and profit attributable to owners of parent. Consolidated operating income was selected as a performance indicator because it was judged appropriate as an evaluation indicator that properly reflects the profits generated by the Group’s core business, and profit attributable to owners of parent was selected as a performance indicator because it provides the results of investments aimed at growth and funds for shareholder returns, and because it was judged appropriate as an indicator from the perspective of being responsible for the Group’s ultimate performance.

Non-monetary remuneration, etc.

We have adopted a system of stock-based remuneration with transfer restrictions, which is designed to pay a yearly fixed amount commensurate with the role of each director and to lift the restriction on transfer at the time of his/her retirement from office.

Amount paid to each director = total performance-linked remuneration (Bonus A)*1

×

Coefficient of each director’s position*2Total coefficients by position

*1: Calculation method for total amount of performance-linked remuneration (Bonus A): Total amount of performance-linked remuneration (Bonus A) = ¥89.76 million x (degree of achievement of consolidated operating income against the annual target x 75% + degree of achievement of profit attributable to owners of parent against the annual target x 25%) Calculated as 130% if the achievement with regard to the annual target exceeds 130%.

*2: Coefficient of each director’s position

Cross-shareholdings

DJK’s policy is to hold shares of other companies only when we judge that such shareholdings contribute to the medium- to long-term improvement of DJK’s corporate value, taking into account whether they are necessary for the purpose of business expansion, business creation, maintenance and strengthening of cooperative structures, and business operations. If we judge that the rationality of shareholding cannot be verified, the shares are sold after taking into consideration the situation of the cross-shareholding partner. The Board of Directors confirms the status of cross-shareholdings each quarter and decides whether to continue or reduce the shareholdings after verifying the purpose, medium- to long-term economic rationality, and whether there is a benefit commensurate with capital cost. In the fiscal year ended March 31, 2024, DJK sold out four stocks and reduced one stock.

Information Disclosure System

Policy on Constructive Dialogue with Shareholders

Representative Director, President & CEO and other directors and executive officers actively participate in business results briefing meetings and other dialogues with investors, and conduct investor relations (IR) activities that emphasize fairness, accuracy, and continuity in management strategies, business strategies, and financial information, as well as good two-way communication.

As a structure for IR activities, the IR Committee is organized by the department in charge of IR and consists of personnel from the Accounting Division, Administration Division, and Corporate Strategy Division. The committee decides on policies for effective IR activities.

With the attendance of Representative Director, President & CEO and other members of the management team, the committee strives to promote investment opportunities and information disclosure by holding business results briefing meetings and publishing business reports and annual reports.

Information Disclosure

To enhance the transparency of its business, the Company proactively discloses information on a timely basis mainly through the Corporate Communication Department. In addition, as one of its IR activities, the Company holds business results briefing meetings to report on and explain business conditions and the future direction of the DJK Group to shareholders and investors.

At the same time, we promptly and appropriately disclose management information via our corporate website and other forms of communication.

Internal Control System

Development of the Internal Control System

The Company has established a “Basic Internal Control Policy” to ensure that the directors perform their duties in compliance with laws and regulations and DJK’s articles of incorporation, and to ensure the appropriateness of our operations as a corporation.

From the perspective of further strengthening corporate governance, the directors endeavor to build an effective internal control system and establish a structure for company-wide legal compliance, while Audit & Supervisory Board members audit the effectiveness and functioning of the internal control system. If and when necessary, Audit & Supervisory Board members must provide advice or recommend improvements to directors.

Basic Policy for Internal Control

- Systems to ensure that directors comply with laws and regulations and Articles of Incorporation in the execution of their business duties

- System to store and manage information on business execution by directors

- Systems providing rules to manage possible losses and other matters of the Company, and its subsidiaries

- Systems to ensure that directors carry out job execution effectively

- Systems for ensuring that directors, executive officers, and employees execute their business duties in accordance with laws and regulations and the Articles of Incorporation

- System to ensure the fairness of operations of the corporate group comprising the parent company and its subsidiaries

- System for requesting staff to aid Audit & Supervisory Board members and ensuring the independence of those staff members from the influence of directors and the effectiveness of instructions given to such assisting staff

- System for directors, executive officers, and employees of the Company and its subsidiaries to report to Audit & Supervisory Board members of the Company, system for making other reports to Audit & Supervisory Board members, and system to ensure effective audit of Audit & Supervisory Board members

Risk Management

Response to the Risks Surrounding Management and Business

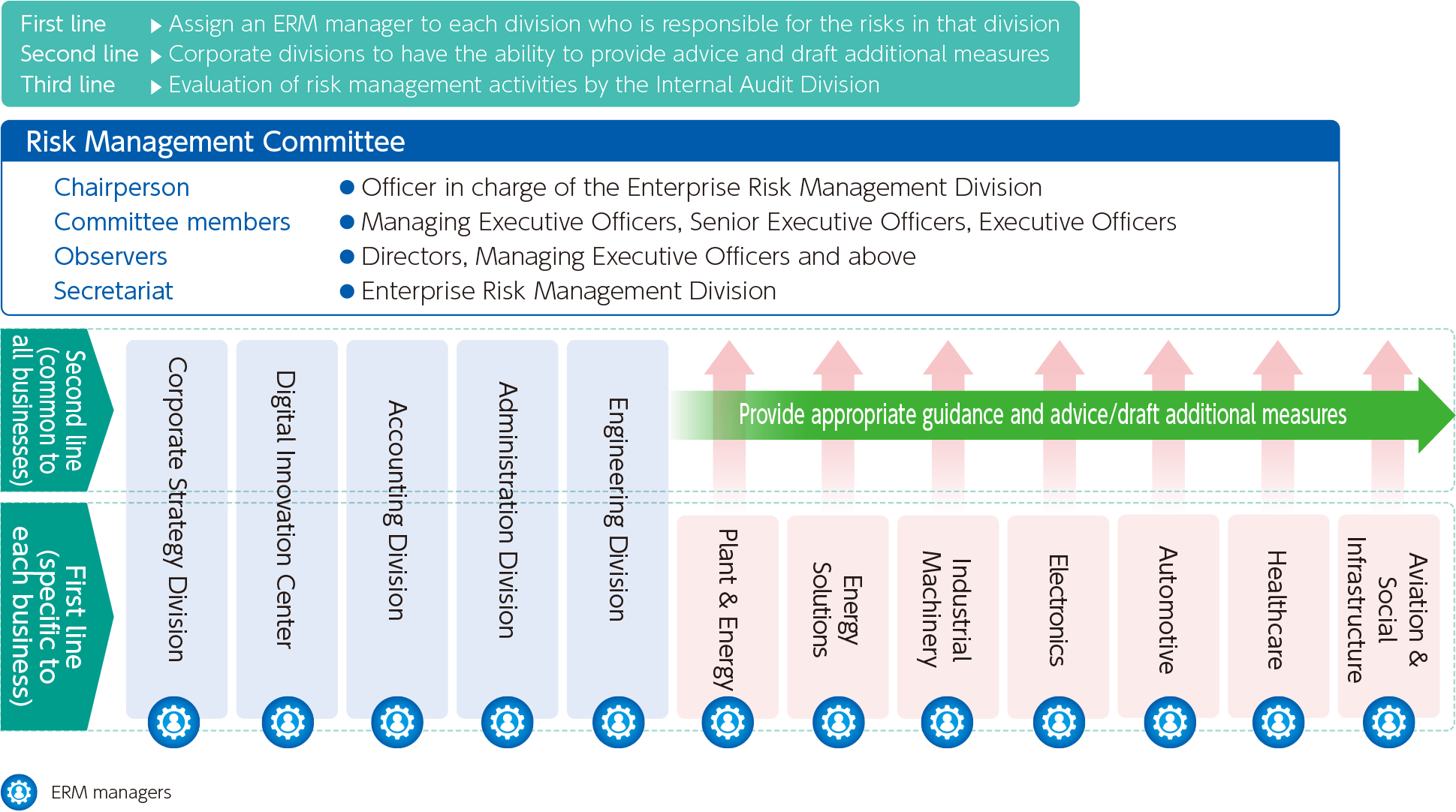

We have established our V2030 growth strategy setting forth basic strategies such as aggressive investment, the shift from product-only sales to products and integrated solutions business model, capturing global growth, and the promotion of digital transformation (DX). In this context, we have identified the creation of new businesses as a key strategy. To accomplish this, it is vital that we make full use of a diverse range of methods to create businesses. In addition to conventional trading (buying and selling activities), these include methods such as business investment, trading that incorporates the provision of solutions, and cross-border business utilizing our overseas and domestic networks. These entail an increase in the scale and complexity of transactions and a rise in DJK’s business risks. In response to such business risks, we have established an enterprise risk management (ERM) system that identifies, weights, and prioritizes risks across the Group, responds to those risks, and then monitors and makes improvements in order to pursue sustainable growth while fulfilling our corporate social responsibilities.

New Risk Management System

We have established an organized and systematic approach to comprehensively and efficiently identify, evaluate, and manage all risks (uncertainties) that threaten the realization of sustainable growth.

We recognize events (both positive and negative) that may have an impact on our strategies and the achievement of our business objectives as risks, and have established mechanisms and processes to manage them appropriately across the entire organization. After clarifying our approach to the amount of risk we are willing to accept (risk appetite), we comprehensively identify risks, conduct qualitative and quantitative assessments of each risk from such perspectives as its impact, frequency, and predictability, and consider countermeasures from the perspectives of avoidance, reduction, transfer, acceptance, etc.

As core divisions that will drive ERM, we established the Enterprise Risk Management Division in April 2023, and the ERM Promotion Department in April 2024, and implemented the following initiatives.

- Restructured the Risk Management Committee

- Formulated our Basic Policy on Risk Management

- Revised the risk management rules

- Revised the Policies of Dividing Duties to clarify the roles and responsibilities of business divisions and administrative divisions

- Formulated our business risk model and risk catalog

- Formulated a risk management manual

- Risk management training (ERM awareness raising)

We have established a risk management system based on the three-line model shown in the diagram below.

Compliance

As the basis of the compliance system, we are working to ensure that the Code of Conduct is thoroughly understood within the Company. We have established the Internal Audit Division under the direct control of representative directors and formulated internal audit regulations. While promoting the establishment, maintenance, and improvement of the internal control system, we are also working to develop and maintain the compliance system, and conduct audits and training in each internal department as necessary.

We have established an internal reporting system, operated based on our internal reporting regulation, as an internal reporting system for reporting violations of laws and regulations and other compliance-related facts, under which the General Manager of the Internal Audit Division is the direct recipient of information.

DJK Group Code of Conduct

In our aim to achieve further growth as a company, Daiichi Jitsugyo Group established its corporate philosophy in April 2022, and in April 2024, it revised the Daiichi Jitsugyo Code of Conduct as the DJK Group Code of Conduct in order to respond to the demands of society arising from the changing times through integrated Group efforts.

The Code of Conduct sets forth in specific terms the values, outlook, and standards of conduct required for the DJK Group to gain and maintain the trust of our stakeholders and to put into practice both its founding philosophy and the corporate philosophy’s mission of “Connecting People, Connecting Technology and Enriching the World.” It is a guideline to which all officers and employees of the DJK Group must adhere. The cumulative actions of each and every one of us are what make up the business activities of the DJK Group. We will contribute to sustainable growth and to society while demonstrating our individuality and abilities, based on a recognition of our responsibility to future generations under the Code of Conduct.

- Maintaining a sense of ethics and compliance with laws and regulations

- Respect for human rights

- Environmental issues

- Improving the working environment for employees

- Winning the trust of business partners

- Mutual development with business partners

- Participating in and contributing to local communities

- Engagement with stakeholders

- Preventing bribery and corruption

- Dealing with antisocial forces

Initiatives at Group companies

Domestic affiliated companies (Daiichi Mecha-tech Corporation, Daiichi Jitsugyo Viswill Co., Ltd., and DJ-WAVE Engineering Co., Ltd.) are promoting compliance in accordance with the DJK Group Code of Conduct.

We are also working to strengthen compliance at our overseas affiliated companies in accordance with the DJK Group Code of Conduct, and will create and maintain appropriate global compliance systems suited to the circumstances of each region: Europe, the Americas, China, and Asia.

Please see this page for the Corporate Governance Report.