Basic Corporate Governance Policy

Under its corporate philosophy of “Connecting People, Connecting Technology and Enriching the World,” DJK strives to enhance corporate value through sustainable business activities. To share the outcomes of these efforts with all stakeholders, including shareholders, DJK believes that it is essential to reinforce its corporaNon-Monetary te governance, which serves as the foundation of its management. Accordingly, DJK’s basic policy is to consistently pursue more sound, transparent, and efficient practices, taking into consideration the characteristics of its business.

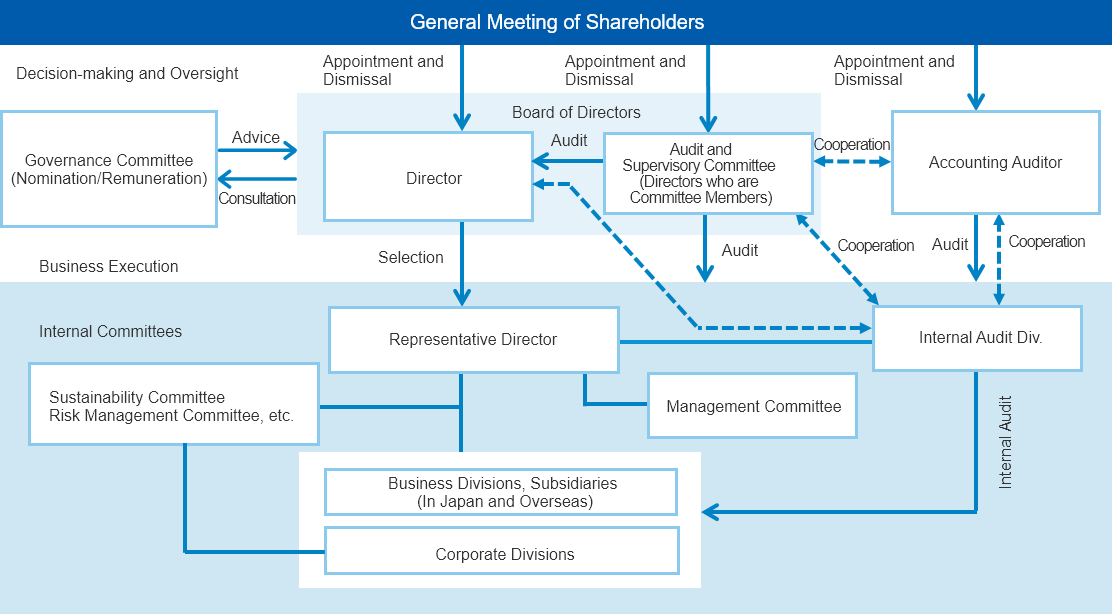

Based on this basic approach, the Company has transitioned from a company with an Audit & Supervisory Board to a company with an Audit and Supervisory Committee, with the approval at the Ordinary General Meeting of Shareholders on June 24, 2025. The Company seeks to separate supervisory and executive functions, striving to balance effective supervisory oversight with timely and flexible decision-making adapted to environmental changes

Evolution of Corporate Governance

DJK is committed to strengthening corporate governance by ensuring the diversity of the Board of Directors while also making the Board progressively more effective through measures such as effectiveness evaluation and the establishment of the Governance Committee.

Corporate Governance System

Enlarge

Enlarge

Board of Directors

The Board of Directors consists of 12 directors (including five Member of the Board (Independent) and three members of the Audit Committee). The board determines basic business policies and other important matters through vigorous exchanges of opinions while also fulfilling its function as an oversight body for business execution.

Moreover, in an effort to further enhance its corporate value, the Company has adopted the executive officer system to conduct flexible and efficient business operations by reinforcing the business decision making and supervising functions, as well as separating the business execution function. The Company dispatches certain executive officers to be in charge of its consolidated subsidiaries in Japan and overseas and to manage their business execution.

Audit and Supervisory Committee

The Company transitioned to a company with an Audit and Supervisory Committee, as approved by shareholders at the 102nd Ordinary General Meeting of Shareholders held on June 24, 2025, thereby changing its governance structure from a company with an Audit & Supervisory Board. Of the three Committee Members, two are Outside Directors. The Audit and Supervisory Committee Members attend all Board of Directors meetings, and the full-time member also participates in key internal meetings to monitor the execution of duties by directors from an objective standpoint.

The Committee works to ensure the effectiveness of audits by receiving reports and explanations from the Accounting Auditor regarding the audit plan and audit results, exchanging views on the scope, methods, and outcomes of audits, and facilitating information sharing.

Independent Auditor and the Internal Audit System

The Company has concluded an auditing agreement with the certified public accounting firm Deloitte Touche Tohmatsu LLC to act as its independent auditor. In addition to providing accounting auditing services in a fair and unbiased manner, the auditing firm provides advice on accounting matters as appropriate.

As for the internal audit system of which the central organ is the Internal Audit Division, the job execution of employees is checked and assessed as to whether it is in accordance with laws and regulations and the Articles of Incorporation, as well as with the basic internal control policy and the code of conduct.

Voluntary Committees

Governance Committee

The Governance Committee was established on October 1, 2020, and has been operated as a voluntary advisory body to the Board of Directors to deliberate on matters related to the nomination and remuneration of top management (directors with representative authority) and directors, as well as other governance matters, and to report and make proposals to the Board of Directors, with the aim of enhancing corporate value by utilizing the knowledge and advice of Member of the Board (Independent), ensuring transparency and fairness, and strengthening governance. The composition and activities of the committee are outlined below.

Board of Directors

Attendance of Meetings (FY2024)

Evaluating the Effectiveness

With regard to the effectiveness of the Board of Directors, the Board confirmed that efforts were being made to improve issues identified in the previous fiscal year’s effectiveness evaluation and the effectiveness of its response during the current fiscal year.

The following initiatives were taken in the fiscal year ended March 31, 2024 based on the issues identified in the Board of Directors’ effectiveness evaluation results for the year ended March 31, 2023. The Board will continue to work continuously to resolve issues.

State of Initiatives to Address Issues Identified in the Previous Fiscal Year

Issues and Actions to be Taken in the Future

- Ensure further diversity in the composition of the Board of Directors

- Establishment of an optimal governance system for the Company's business activities

- Promote discussion aimed at enhancing corporate value over the medium to long term

- Ensure sufficient time for consideration of meeting materials in advance of meetings of the Board of Directors

Directors

Reason for Appointment

Board of Directors (Excluding Member of the Board and Audit & Supervisory Committee)

Member of the Board, Audit & Supervisory Committee

Skill Matrix of Directors

Notes:

- 1. Technology, IT, and Digital Transformation

- 2. Knowledge of other industries

Training Policy for Directors and Audit & Supervisory Board Members

Newly appointed officers are required to attend officer seminars provided by an outside institution.

All officers and employees in executive positions receive regular training sessions from lawyers and other outside lecturers to acquire the necessary knowledge.

They participate in important meetings such as internal management strategy meetings and corporate sales meetings to deepen their understanding of the Company’s business, legal matters, financial conditions, organizational matters, and so forth.

Officers’ Remuneration

Policy on Determining the Amount or Calculation Method for the Amount of Remuneration for Officers

The Company has established a policy regarding the determination of the amount or calculation method for the amount of remuneration for officers, which encourages medium- to long-term growth of business performance and corporate value. The remuneration system is commensurate with the duties of each officer.

The Governance Committee, upon consultation from the Board of Directors, deliberates and advises the Board on remuneration for individual directors other than Member of the Board (Independent). The Board of Directors deliberates on the advice from the Governance Committee and determines the amounts of remuneration.

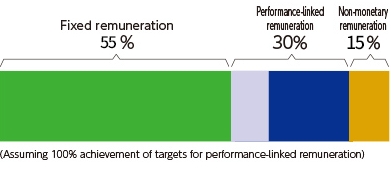

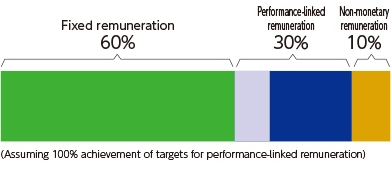

Remuneration for the Company’s officers is composed of fixed remuneration, performance-linked remuneration, non-monetary remuneration, etc. The relative proportions of each form of remuneration for executive directors and the amounts of remuneration are determined by the Board of Directors based on comparison and verification with the composition of remuneration at other companies of a similar scale in the same industry and the remuneration paid previously, as well as consultation and advice from the Governance Committee, from the perspective of ensuring objectivity and appropriateness. Remuneration for outside directors, including Audit & Supervisory Board members in light of the independence of their positions, consists of fixed remuneration and non-performance-linked stock Compensation only. Decisions on the amount of remuneration are made to the extent of the total amounts passed on in resolutions of the General Meeting of Shareholders.

Overview of the Remuneration System for Directors (Excluding Outside Directors)

DJK aims to further strengthen corporate governance under our medium-term business plan MT2024, launched in FY2022. As part of this plan, we have reviewed our remuneration system for officers in order to further enhance corporate value over the medium to long term.

Based on the resolution adopted by the Ordinary General Meeting of Shareholders held on June 23, 2022, the Company has decided to change the amount of remuneration, etc. for directors from a monthly amount to a yearly amount, and within the amount of such remuneration, directors other than outside directors will be paid a bonus in the form of performance-linked remuneration in addition to fixed remuneration. Taking into account trends in the level of remuneration, the number of directors, and future prospects in a comprehensive manner, the total amount of remuneration was set at no more than ¥460 million per year by resolution of the Ordinary General Meeting of Shareholders held on June 24, 2025.

Total Remuneration, Total Remuneration by Type, and Number of Applicable Officers for Each Officer Classification

Fixed Remuneration

A monthly fixed amount of remuneration commensurate with the clarified roles and responsibilities of each position is paid in cash.

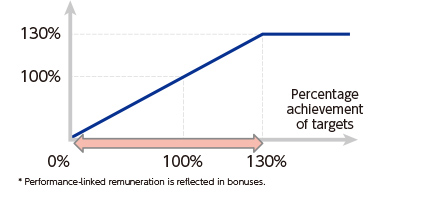

Performance-Llinked Rremuneration

There are two kinds of bonuses to be paid: bonus linked to the Company’s business results indicators (hereinafter, “bonus A”) and bonus linked to indicators, etc. contributing to the achievement of the medium-term business plan (hereinafter, “bonus B”). Bonus A is paid in cash based on the degree of achievement of the consolidated performance targets, and bonus B is paid in cash according to the degree of achievement of the indicators, etc. contributing to the achievement of the medium-term business plan. The amounts vary within the range of 0% to 130% of the base amount.

Method for Calculating Performance-Linked Remuneration (Bonus A)

Performance indicators for performance-linked remuneration (bonus A) are consolidated operating income and profit attributable to owners of parent.

Consolidated operating income was selected as a performance indicator because it was judged appropriate as an evaluation indicator that properly reflects the profits generated by the Group’s core business, and profit attributable to owners of parent was selected as a performance indicator because it provides the results of investments aimed at growth and funds for shareholder returns, and because it was judged appropriate as an indicator from the perspective of being responsible for the Group’s ultimate performance.

Non-Monetary Remuneration, etc.

We have adopted a system of stock-based remuneration with transfer restrictions, which is designed to pay a yearly fixed amount commensurate with the role of each director and to lift the restriction on transfer at the time of his/her retirement from office.

Amount paid to each director = total performance-linked remuneration (Bonus A)1

Coefficient of Each Director’s Position2

Total coefficients by position

Notes:

- 1. Calculation method for total amount of performance-linked remuneration (bonus A): Total amount of performance-linked remuneration (bonus A) = ¥104,560 thousand x (degree of achievement of consolidated operating income against the annual target x 75% + degree of achievement of profit attributable to owners of parent against the annual target x 25%)

Calculated as 130% if the achievement with regard to the annual target exceeds 130%

- 2. Coefficient of each director's position

Coefficient of Each Director’s Position

Proportion of Each Remuneration by Type

Case of Member of the Board

In the Case of Directors Excluding the Representative Directors

Incentive Curve for Performance-Linked Remuneration

Cross-Shareholdings

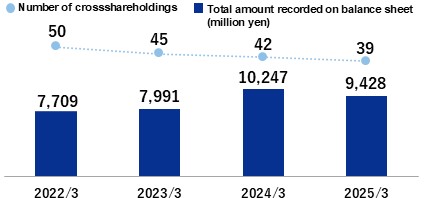

Changes in the number of cross-shareholdings and the amount recorded on the balance sheet

DJK’s policy is to hold shares of other companies only when we judge that such shareholdings contribute to the medium- to long-term improvement of DJK’s corporate value, taking into account whether they are necessary for the purpose of business expansion, business creation, maintenance and strengthening of cooperative structures, and business operations. If we judge that the rationality of shareholding cannot be verified, the shares are sold after taking into consideration the situation of the cross-shareholding partner. The Board of Directors confirms the status of cross-shareholdings each quarter and decides whether to continue or reduce the shareholdings after verifying the purpose, medium- to long-term economic rationality, and whether there is a benefit commensurate with capital cost. In the fiscal year ended March 31, 2025, DJK sold out three stocks and reduced two stocks.

Information Disclosure System

Policy on Constructive Dialogue with Shareholders

Directors and executive officers, including Member of the Board, President & COO, actively participate in business results briefing meetings and other dialogues with investors, and conduct IR activities that emphasize fairness, accuracy, and continuity in management strategies, business strategies, and financial information, as well as good two-way communication.

- Director Supervising IR Activities

A director has been appointed to oversee the Investor Relations (IR) division.

- System for IR Activities

Policy on IR activities is determined based on discussions led by the department in charge of IR in collaboration with the Accounting Division, the Administration Division, and the Strategy Division.

- Methods of Shareholder Engagement

The Company promotes investment opportunities and strives to enhance information disclosure through activities such as earnings briefings attended by the Member of the Board, President & COO and other members of the management team, as well as by publishing business reports and integrated reports. When deemed necessary, Outside Directors and Directors serving on the Audit and Supervisory Committee also participate in meetings with investors.

- Internal Feedback Mechanisms

Outcomes from business results briefing meetings, company presentations, and meetings with institutional investors are reported to the management team and shared with the Board of Directors to contribute to the enhancement of corporate value.

- Management of Insider Information

The Company ensures that its internal rules on handling insider information are thoroughly communicated to all officers and employees. In addition, by centralizing all investor inquiries through the IR division, the Company reinforces its insider information controls.

| Activities in FY2024 |

- Business results briefing meetings: Twice a year (May and November)

- Briefings for individual investors: Five times a year (August (twice), December, January, and February)

- Meetings with investors: 29 meetings throughout the year

|

Information Disclosure

To enhance the transparency of its business, the Company proactively discloses information on a timely basis

mainly through the Corporate Communication Department. In addition, as one of its IR activities, the Company

holds business results briefing meetings to report on and explain business conditions and the future direction of

the DJK Group to shareholders and investors. At the same time, we promptly and appropriately disclose

management information via our corporate website and other forms of communication.